In the world of financial markets, Elliott Wave Sage Twitter has emerged as a powerful tool for traders and investors alike. This platform offers insights into market trends using the Elliott Wave Theory, helping users make informed decisions. Whether you're a seasoned trader or just starting your journey, understanding Elliott Wave Sage Twitter is essential for navigating the complexities of trading.

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a technical analysis method that identifies price patterns in financial markets. Over the years, it has gained popularity, and platforms like Elliott Wave Sage Twitter have become vital resources for enthusiasts. By leveraging this theory, traders can anticipate market movements with greater accuracy.

As we delve deeper into this topic, we will explore the intricacies of Elliott Wave Sage Twitter, its applications, and how it can enhance your trading strategy. This article aims to provide a detailed understanding of the platform, ensuring that you are well-equipped to harness its potential.

Read also:Daysfan28 Twitter Unveiling The Online Persona And Influence

Understanding Elliott Wave Theory

Elliott Wave Theory is a cornerstone of technical analysis that focuses on identifying repetitive patterns in market prices. The theory suggests that markets move in predictable cycles, driven by investor psychology. These cycles consist of impulsive waves (trends) and corrective waves (retracements).

The theory is based on the premise that markets are not random but rather follow a rhythmic pattern. Traders who understand these patterns can anticipate market movements and adjust their strategies accordingly.

Key Components of Elliott Wave Theory

- Impulsive Waves: These waves move in the direction of the larger trend and consist of five sub-waves.

- Corrective Waves: These waves move against the trend and consist of three sub-waves.

- Fractals: Smaller waves within larger waves, indicating that the theory applies across different timeframes.

By understanding these components, traders can better interpret market movements and make more informed decisions.

What is Elliott Wave Sage Twitter?

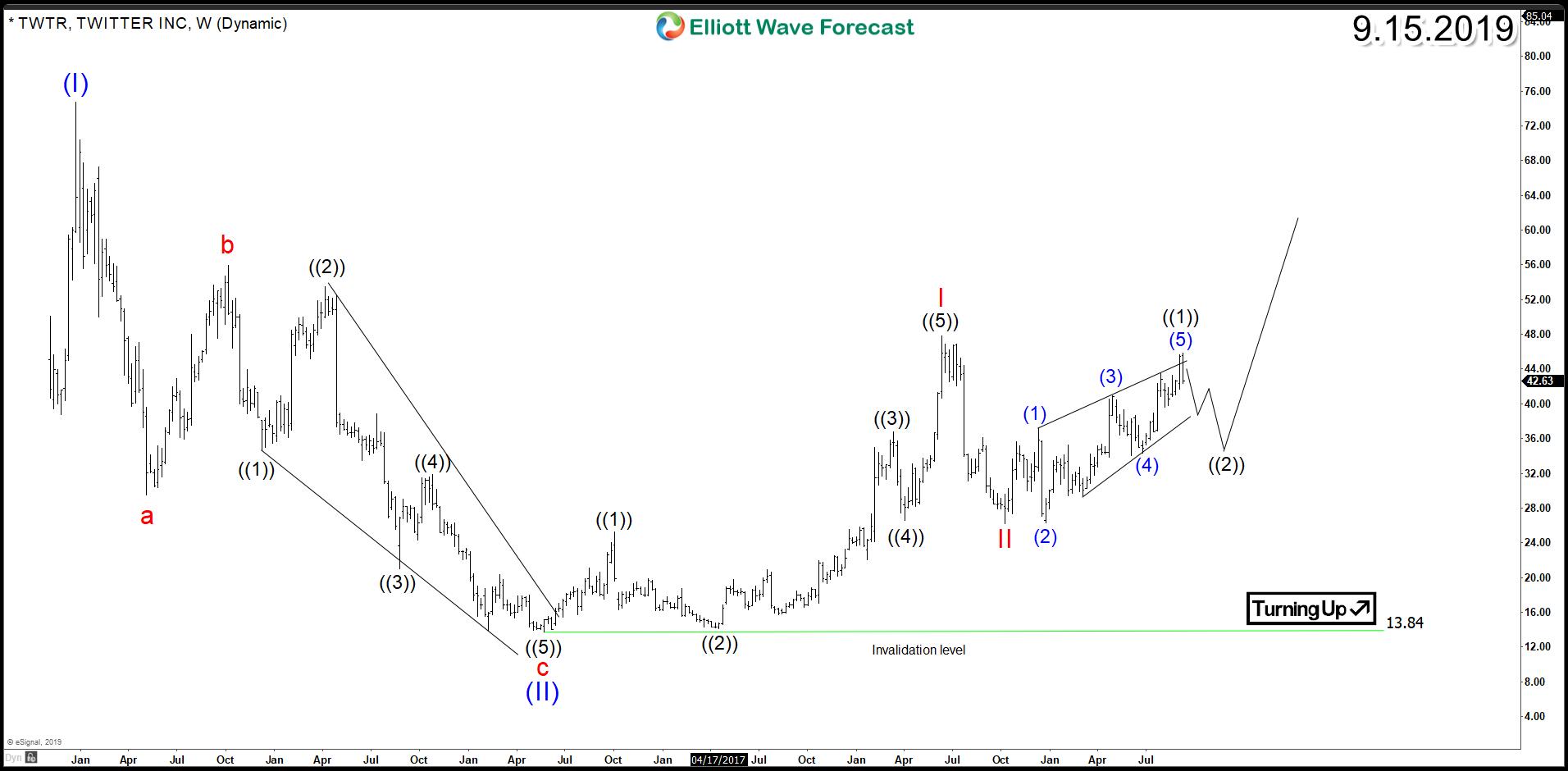

Elliott Wave Sage Twitter is a platform where experts and enthusiasts share their insights into market trends using Elliott Wave Theory. It serves as a hub for traders to exchange ideas, analyze charts, and discuss market conditions. The platform's active community provides real-time updates and analysis, making it an invaluable resource for traders.

The platform's strength lies in its ability to connect individuals with diverse perspectives, fostering a collaborative environment for learning and growth. Whether you're looking for educational content or seeking expert opinions, Elliott Wave Sage Twitter has something to offer.

How Elliott Wave Sage Twitter Works

Elliott Wave Sage Twitter operates through a network of users who post updates, charts, and analysis related to financial markets. These posts often include detailed explanations of market movements based on Elliott Wave Theory. Users can engage with the content by commenting, sharing, or liking posts, creating a dynamic and interactive experience.

Read also:Twitter Baddie The Ultimate Guide To Understanding The Phenomenon

Additionally, the platform hosts webinars, tutorials, and live sessions to educate users about the intricacies of Elliott Wave Theory. These resources are designed to help traders improve their skills and enhance their understanding of market dynamics.

Benefits of Using Elliott Wave Sage Twitter

Traders who utilize Elliott Wave Sage Twitter can benefit from the platform's wealth of knowledge and resources. Here are some key advantages:

- Access to expert analysis and insights.

- Real-time updates on market trends and conditions.

- Opportunities to engage with a global community of traders.

- Comprehensive educational content to improve trading skills.

By leveraging these benefits, traders can enhance their decision-making capabilities and increase their chances of success in the financial markets.

Applications of Elliott Wave Theory in Trading

Elliott Wave Theory is widely used in trading to forecast market movements and identify potential entry and exit points. Traders apply the theory to various financial instruments, including stocks, commodities, and currencies. By analyzing wave patterns, traders can anticipate price movements and adjust their strategies accordingly.

Steps to Apply Elliott Wave Theory in Trading

- Identify the current wave pattern on a chart.

- Determine the direction of the larger trend.

- Locate potential support and resistance levels.

- Set entry and exit points based on wave projections.

These steps provide a structured approach to applying Elliott Wave Theory in trading, helping traders make more informed decisions.

Challenges and Limitations of Elliott Wave Theory

While Elliott Wave Theory is a powerful tool, it is not without its challenges and limitations. One of the primary challenges is the subjective nature of wave interpretation. Different analysts may interpret the same wave pattern differently, leading to conflicting predictions. Additionally, the theory requires a deep understanding of market dynamics and technical analysis, which can be daunting for beginners.

Overcoming Challenges in Elliott Wave Analysis

To overcome these challenges, traders can:

- Seek guidance from experienced analysts and educators.

- Practice wave analysis on historical data to improve accuracy.

- Combine Elliott Wave Theory with other technical indicators for a more comprehensive analysis.

By addressing these challenges, traders can enhance their ability to apply Elliott Wave Theory effectively in their trading strategies.

Case Studies: Successful Applications of Elliott Wave Theory

Several case studies highlight the successful application of Elliott Wave Theory in trading. For instance, during the 2008 financial crisis, traders who applied the theory were able to anticipate market downturns and adjust their portfolios accordingly. Similarly, in the cryptocurrency market, Elliott Wave Theory has been used to predict price movements and identify profitable trading opportunities.

Case Study: Cryptocurrency Trading

In 2021, Bitcoin experienced significant price fluctuations, presenting both challenges and opportunities for traders. Those who applied Elliott Wave Theory were able to identify key support and resistance levels, allowing them to make informed trading decisions. This case study demonstrates the theory's relevance in modern financial markets.

Tools and Resources for Elliott Wave Analysis

Traders looking to apply Elliott Wave Theory can utilize a variety of tools and resources. These include charting software, educational platforms, and online communities like Elliott Wave Sage Twitter. By leveraging these resources, traders can enhance their understanding of the theory and improve their trading performance.

Recommended Tools for Elliott Wave Analysis

- TradingView: A popular charting platform with built-in Elliott Wave tools.

- Investopedia: A comprehensive resource for learning about Elliott Wave Theory and other trading concepts.

- Elliott Wave International: A leading provider of educational content and analysis based on Elliott Wave Theory.

These tools offer valuable resources for traders seeking to master Elliott Wave Theory and its applications.

Building a Trading Strategy with Elliott Wave Theory

Developing a trading strategy based on Elliott Wave Theory requires a systematic approach. Traders should begin by identifying their goals and risk tolerance, then incorporate the theory into their overall strategy. This involves setting clear entry and exit points, managing risk effectively, and continuously refining the strategy based on market conditions.

Steps to Build an Effective Trading Strategy

- Define your trading objectives and risk parameters.

- Analyze historical data to validate wave patterns.

- Backtest your strategy using simulated trades.

- Implement and monitor the strategy in live markets.

By following these steps, traders can create a robust strategy that incorporates the principles of Elliott Wave Theory.

Conclusion and Call to Action

In conclusion, Elliott Wave Sage Twitter offers a valuable resource for traders seeking to enhance their understanding of market trends and improve their trading strategies. By leveraging the insights and tools provided by this platform, traders can make more informed decisions and increase their chances of success in the financial markets.

We encourage readers to engage with the Elliott Wave Sage Twitter community, explore the resources mentioned in this article, and apply the principles of Elliott Wave Theory to their trading strategies. Don't hesitate to share your thoughts and experiences in the comments section below, and consider exploring other articles on our site for further insights into the world of trading.

Table of Contents

- Understanding Elliott Wave Theory

- What is Elliott Wave Sage Twitter?

- Benefits of Using Elliott Wave Sage Twitter

- Applications of Elliott Wave Theory in Trading

- Challenges and Limitations of Elliott Wave Theory

- Case Studies: Successful Applications of Elliott Wave Theory

- Tools and Resources for Elliott Wave Analysis

- Building a Trading Strategy with Elliott Wave Theory

- Conclusion and Call to Action

- Table of Contents

Data sources: Investopedia, Elliott Wave International, TradingView.